Embedded lending has become one of the most innovative and exciting areas of fintech. A newer area gaining serious momentum, many people are quickly learning how life-changing it can be. Simply put, embedded lending is when lending is offered through non-financial products or services. This way, consumers have the ability to both apply for and receive a loan on a digital platform directly with a merchant. No more friction, the end of delays, simple payments, and enhanced security are some of the ways that fintechs have disrupted and reimagined consumer lending.

Choosing a loan through an embedded lending solution eliminates the need to apply at a bank or use a separate application from a third party to access financing. By use of APIs that integrate the whole process, non-financial companies act as the bridge between the lending institutions and end consumers. Consumers are able to stay inside the buying journey because the whole process — loan application, verification and approval, credit, and repayment is digital. That means everything needed is all in one place, allowing consumers to gain access to a loan with only a few clicks.

The Future of Embedded Lending Is Bright

The world took notice when embedded lending solved issues that traditional lending presented. Because of the countless benefits for merchants and consumers, the overall ease and convenience, and the advanced technology involved, it comes as no surprise that embedded lending is on the rise in a big way. Bain & Company research shows that financial services embedded into e-commerce and other software platforms accounted for $2.6 trillion, or nearly 5%, of total U.S. financial transactions in 2021, and by 2026 will exceed $7 trillion. They forecast that embedded point-of-sale lending will slowly but steadily take market share with revenues to jump from $4.2 billion in 2021 to $7.5 billion in 2026.

What Are the Benefits for Merchants?

Embedded lending gives a merchant the opportunity to offer loan products directly to consumers through a digital platform. There are many more benefits besides removing the need for a third party and making lending more accessible, they include:

- Digital loan offerings

- Eliminate time spent on detailed paperwork

- Built-in/embedded compliance and security

- Real-time financial decisions

- Build a reputation for being smart, business savvy, and affordable

- Offer consumers a variety of lending options that gives consumers what they need when they need it.

- Receive payments in real-time

- Increase revenue streams

- Decrease the overall cost of transactions

- Higher purchase prices

- Stay ahead of the competition by adopting a cutting-edge tool

- Build customer loyalty

What Are the Benefits for Consumers?

Embedded lending gives consumers the opportunity to borrow through a merchant that they’re buying a product or service from.

Benefits include:

- Variety of attractive loan options to choose from

- Instant decision on approval

- Receive a loan that you need right when you need it

- Save time

- Ease of use

- Convenience

- User-friendly technology

- Never need to leave the buyer’s journey

- Affordable and flexible payment options

- Robust fraud and security protection

- Stress-free lending experience

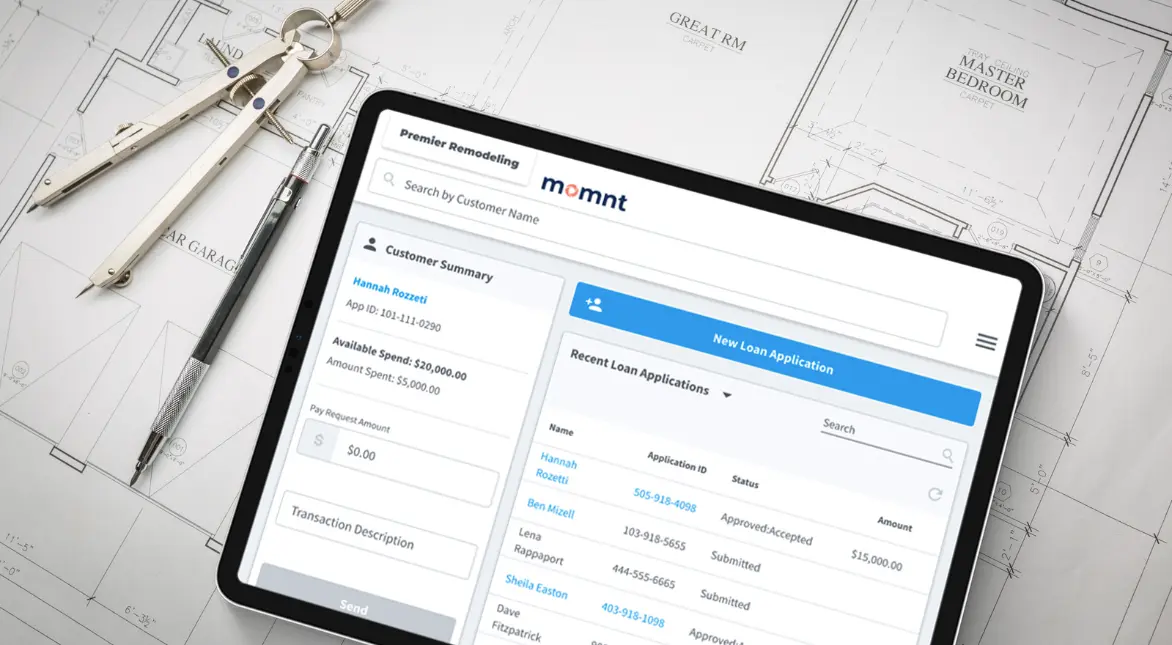

Momnt Offers an Embedded Lending Solution for Merchants

Momnt is a state-of-the-art financial services technology platform that offers an embedded lending solution with built-in compliance. Merchants in the home improvement and healthcare industries are able to provide a flexible line of financing products through a completely digital application and transaction process. Are you a merchant looking to incorporate embedded lending into your business plan and offer this type of financing? Read our blog to learn how to offer financing to your customers, which details everything you need to know from start to finish. If you’d like to schedule a personalized demo with our team, fill out this form.

Once in a while, an innovation comes along that drastically improves the lives of many people. For business owners that need better financing to grow their businesses and for consumers who need affordable and simple payments, embedded lending is that innovation.

Blog Tags